Our Investment Process

We Build Resilient Assets That Outlive Market Cycles.

Our philosophy moves beyond conventional metrics. We build resilient, productive agricultural assets engineered to generate durable cash flow, long-term capital appreciation, and tangible environmental impact.

A Different Kind of Investment In Land

At K2, we approach farmland investment as an operator who unlocks its value by introducing technological solutions to improve crop output and crop quality.

We are Operators, Not Just Owners.

Our team has spent decades building and scaling ag-tech ventures in the US and India. This operational depth allows us to underwrite value where others see risk, and execute on transformations others can only model. Where others see an asset, we see a living system.

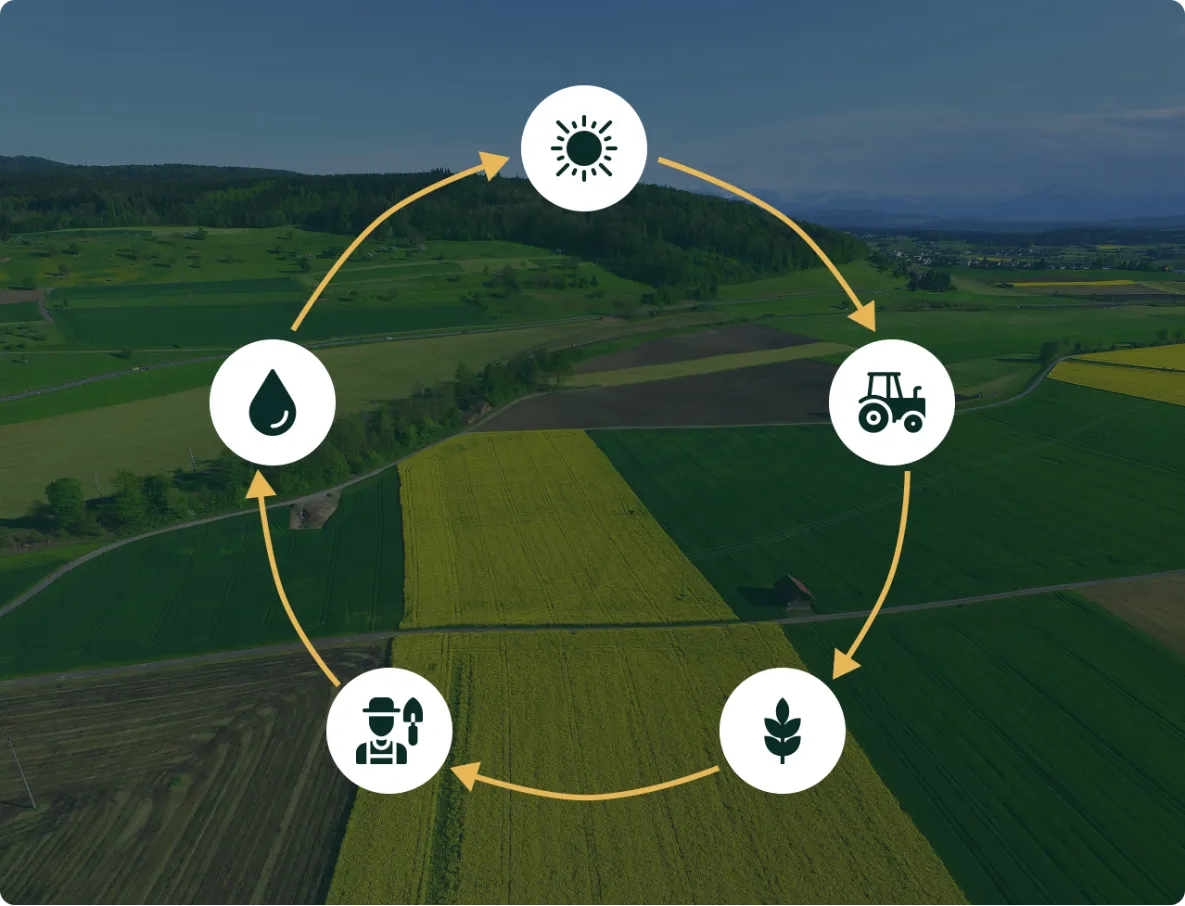

We Design Integrated Ecosystems.

We convert underperforming monoculture farms into diversified agroforestry systems. By integrating high-value perennials, short-cycle crops, and synergistic animal husbandry, we generate multiple, non-correlated revenue streams while enhancing the ecological and economic resilience of the core asset.

Our Network is Our Moat.

Our network, built over decades of on-the-ground operational work, provides access to a proprietary pipeline of off-market opportunities. These are the assets that are never publicly tendered

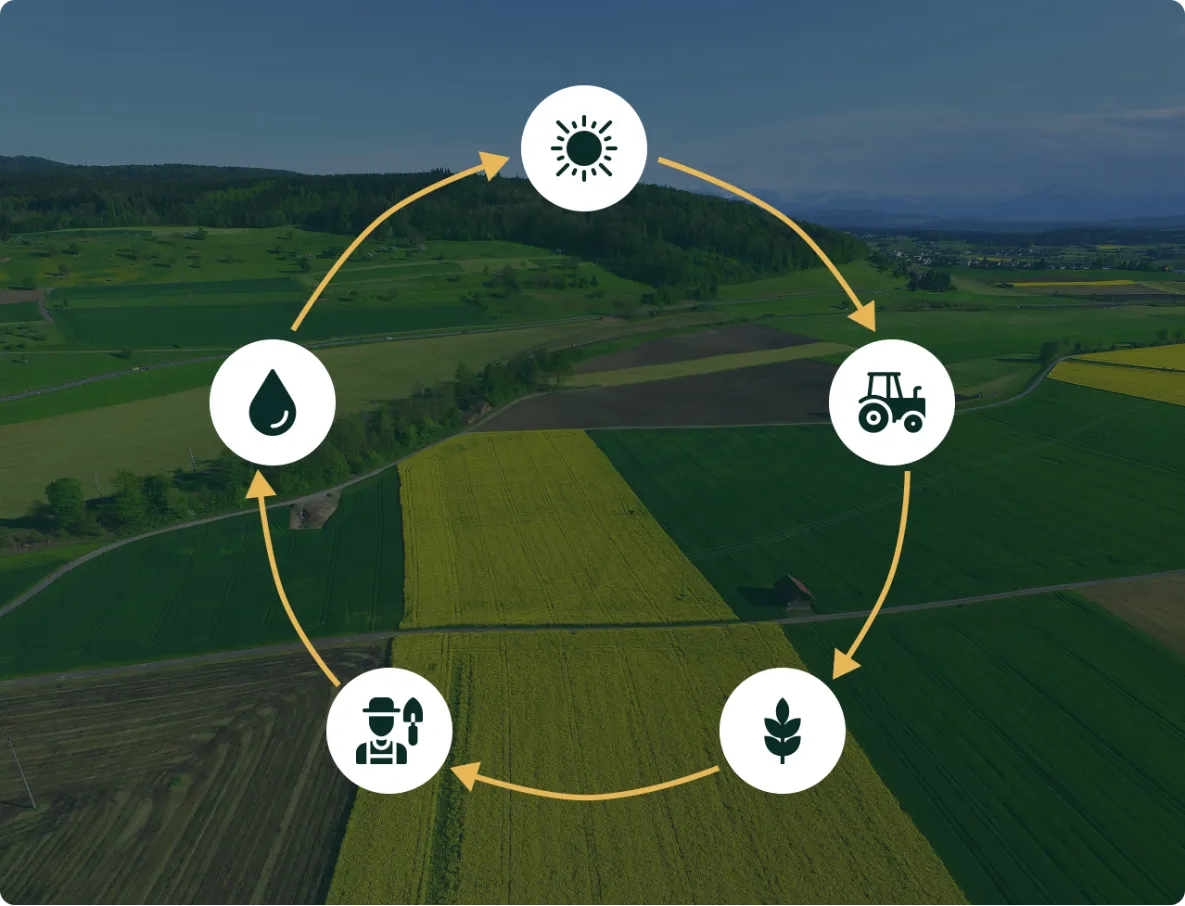

Our Investment Process: A Disciplined Approach

Our system is designed to be operationally complex behind the scenes, yet simple and transparent for our partners.

01 Source

We leverage our proprietary network to source high-potential farmland in India's most productive agro-climatic zones. Our process de-risks the acquisition by ensuring every asset has a clear legal title and is rigorously pre-vetted for the fundamentals of resilience: soil health, water security, and long-term appreciation potential.

02 Evaluate

We protect your capital with rigorous, institutional-grade due diligence. Our team conducts a deep dive into every property, verifying clean title history, analyzing soil and water sustainability, and ensuring full regulatory compliance before we invest.

03 Invest & Optimize

K2 acquires selected assets and transforms them into high-efficiency operations through targeted technological and management interventions. Our expert team manages the entire lifecycle, including soil regeneration, legal compliance, harvesting, and sales. By partnering with us, you receive a stable, fixed annual income completely free of operational responsibilities.

04 Report

Transparency is our currency. You receive regular, structured updates on asset performance, land condition, and rental payouts. Our institutional-grade reporting is clear, data-driven, and, where applicable, supported by third-party verification to ensure you always know the true value of your portfolio.

Our Commitment: A Foundation of Alignment

Seamless Cross-Border Execution

We manage all structuring, legal, and regulatory requirements, allowing our partners to hold global farmland assets with the security of a US-based entity.

Direct Co-Investment

The best conviction isn’t written in pitch decks; it’s written on the balance sheet. Our founders invest in every asset we acquire, stewarding our own capital alongside yours.

Book An Investment Consultation Slot With Our Team

Let’s help you take the first step toward owning farmland that lasts generations.

Connect with us and we'll tell you more

*We’ll never share your information. Our team will reach out personally to guide you through opportunities, the process, and what comes next.

FAQs

Why invest in farmland?

Farmland offers long-term capital appreciation, stable annual yield, and a natural hedge against inflation.

What returns can I expect?

Returns vary by region and strategy, but historically, farmland has delivered 8–12% IRR through income and appreciation.

Is this a passive investment?

Yes. K2 handles all operations, compliance, and reporting — your role is financial, not managerial.

Where does K2 invest?

We currently operate in India, the United States, and Canada — targeting high-potential agro-climatic zones.

Can I invest if I live in a different country?

Yes. We structure each investment to comply with international regulations. You don’t need to reside in or visit the country.

How does K2 manage legal and regulatory risk?

Our team handles all local legal structuring, title verification, and regulatory compliance across jurisdictions.

How does K2 create value from farmland?

Our value comes from operational transformation, improving soil health, diversifying crops, and optimizing productivity.

What makes K2 different from other farmland funds?

We’re operator-led, not financier-first. Our team has hands-on ag-tech experience across 10+ countries and invests personally in every strategy.

What is the minimum investment?

Minimums vary by offering, but typically start around $250,000.